Notice, Job 105 has been moved from Finished Goods Inventory since it was sold and is now reported as an expense called Cost of Goods Sold. Also, did you notice that actual overhead came to $9,800 ($1,000 indirect materials + $2,000 indirect labor + $6,800 other overhead from transaction g) but we applied $9,850 in overhead to the jobs in transaction d? Whenever we use an estimate instead of actual numbers, it should be expected that an adjustment is needed.

Overapplied Overhead

We will discuss the difference between actual and applied overhead and how we handle the differences in the next sections. On the other hand, the indirect labor cost is the cost that cannot be traced to a single job or a single unit of product as such cost is usually related to the production as a whole. For example, the salary of the quality control and inspection personnel usually contributes to all units of goods in the production. The administrative indirect labor cost, on the other hand, is treated as period cost and is expensed in the period of incurrence. Personnel working in accounting, marketing and engineering departments are some examples of administrative indirect labor employees.

Accounting For Actual And Applied Overhead

Companies generally use job cost systems when they can identify separate products or when they produce goods to meet a customer’s particular needs. (2) The majority of the labour costsincurred by a manufacturing organisation are in respect of direct labourcosts. Direct labour what is the difference between notes payable and accounts payable costs are directly involved in production and aretransferred out of the labour account via a credit entry to the WIPaccount as shown above. Indirect labor cost is the cost of labor that is not directly related to the production of goods and the performance of services.

Conceptual Journey of Inventory & Wages Across Financial Statements

It is useful to note that the above journal entries are used in the accounting of job order costing that focuses on the individual job. Finally, any accounts payable and wages payable we earlier credited (when debiting raw materials and wages to assets) should be debited once they are paid. This means cash will also be credited, thereby balancing our balance sheet. At its core, inventory is nothing more than raw materials purchased by the company and transformed into a sellable product or service. The way this plays out on the balance sheet is that raw materials are added as a current asset — but NOT yet inventory — and accounts payable is credited. You should also be careful to remember that WIP become normal inventory on the balance sheet before they are sold.

- Wheneverwe use an estimate instead of actual numbers, it should be expectedthat an adjustment is needed.

- If this sounds complex, don’t worry, we’ll run through examples and journal entries below.

- On the other hand, the indirect labor cost is the cost that cannot be traced to a single job or a single unit of product as such cost is usually related to the production as a whole.

Conversion Costs: Definition, Formula, and Example

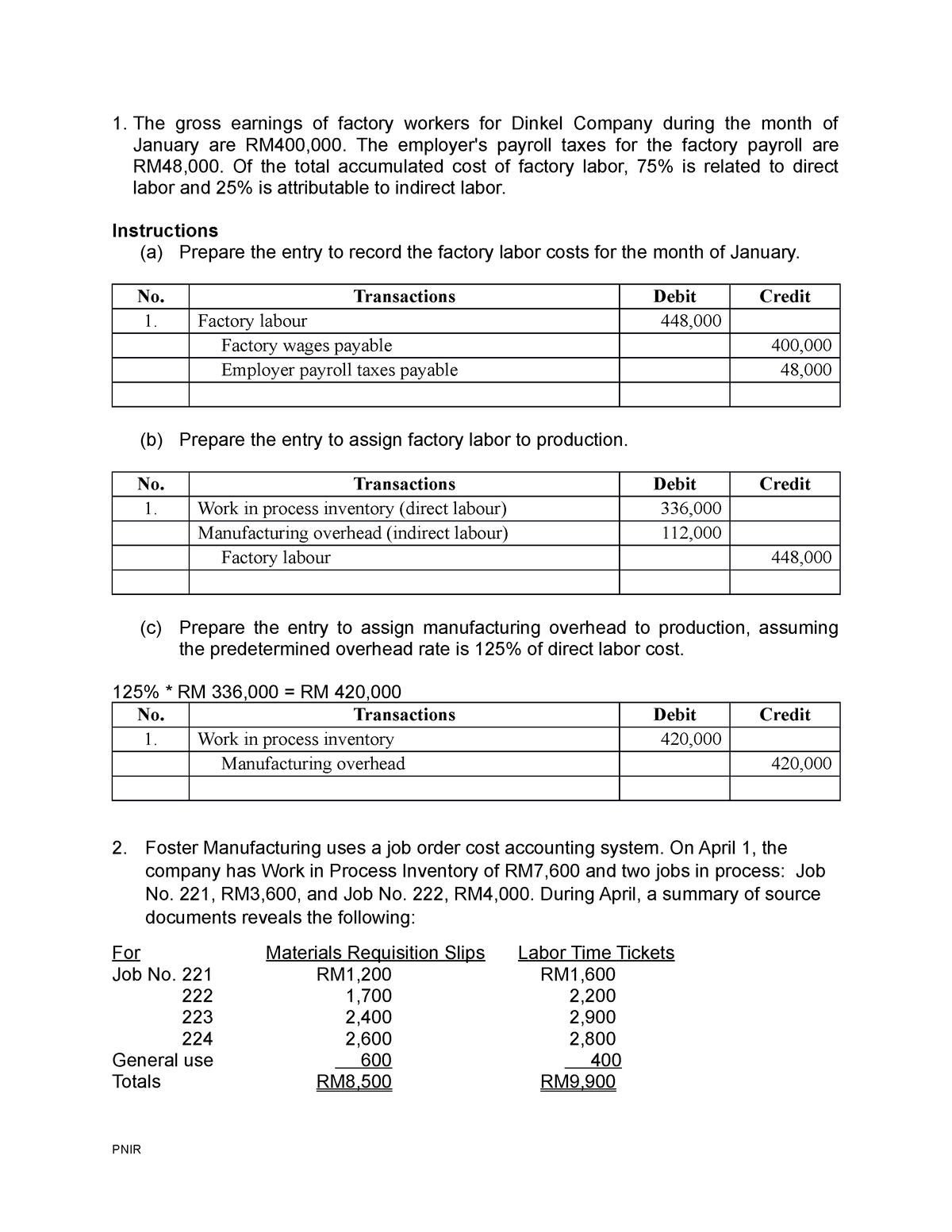

To illustrate a job costing system, this section describes the transactions for the month of July for Creative Printers. In a journal entry, we will do entries for each letter labeled in the chart — where the arrow is pointing TO is our debit and where the arrow is coming FROM is our credit. In job order costing, the company can transfer the cost of direct labor to the work in process inventory and the cost of indirect labor to the manufacturing overhead.

Overhead is assigned to a job at the rate of $ 2 per machine-hour used on the job. Job 16 had 875 machine-hours so we would charge overhead of $1,750 (850 machine-hours x $2 per machine-hour). Job 17 had 4,050 machine-hours so overhead would be $8,100 (4,050 machine-hours x $2).

The computation of inventory for the packaging department is shown in Figure 5.7. Labour is a significant cost in many organisations and it isimportant to continually measure the efficiency of labour againstpre-set targets. In an examination you will be given clear instructions on any bonusscheme in operation. You should follow the instructions given carefullyin order to calculate the bonus payable from the data supplied. We looked at time-based systems, the most common remuneration method, at the beginning of this chapter.

The journal entry to apply or assign overhead to the jobswould be to move the cost FROM overhead TO work in processinventory. These illustrations of the disposition of under- and overapplied overhead are typical, but not the only solution. A more theoretically correct approach would be to reduce cost of goods sold, work in process inventory, and finished goods inventory on a pro-rata basis. However, this approach is cumbersome and occasionally runs afoul of specific accounting rules discussed next. The job cost accounting journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of job costing.

Here is avideo discussion of job cost journal entries and then we will do anexample. Indirect labor is a category of indirect cost and refers to those employees that assist the direct labor in the performance of their work. Of the three ways labor shows on the balance sheet, wages payable and works in progress are connected. The total job costof Job 106 is $27,950 for the total work done on the job, includingcosts in beginning Work in Process Inventory on July 1 and costsadded during July. This entry records the completion of Job 106 bymoving the total cost FROM work in process inventory TO finishedgoods inventory.